Online marketplace payment solutions are digital tools to facilitate transactions between buyers and sellers. Payment solutions ensure that shoppers buy products or services and that sellers receive the funds securely on your online marketplace website.

Each online platform faces its particular marketplace payment challenges. So, you should rely on the best marketplace payment solution with vital features for your ecommerce platform. These solutions are Stripe Connect, Braintree, Dwolla, PayPal Commerce Platform, Mangopay, Adyen, and Exactly.

Read this article to discover which payment gateways are convenient and secure for your online marketplace. Here, we will dig deeper into two-sided marketplace payment processing. Plus, we will analyze popular blockchain and mobile payment solutions for marketplaces.

This overview from our experts will help you choose the best payment gateway for your online marketplace’s needs. Let’s dive into the subject.

Marketplace payment gateway definition

A payment gateway (portal) is a dedicated software application or service designed to securely and effectively handle online transactions between a customer and merchant account.

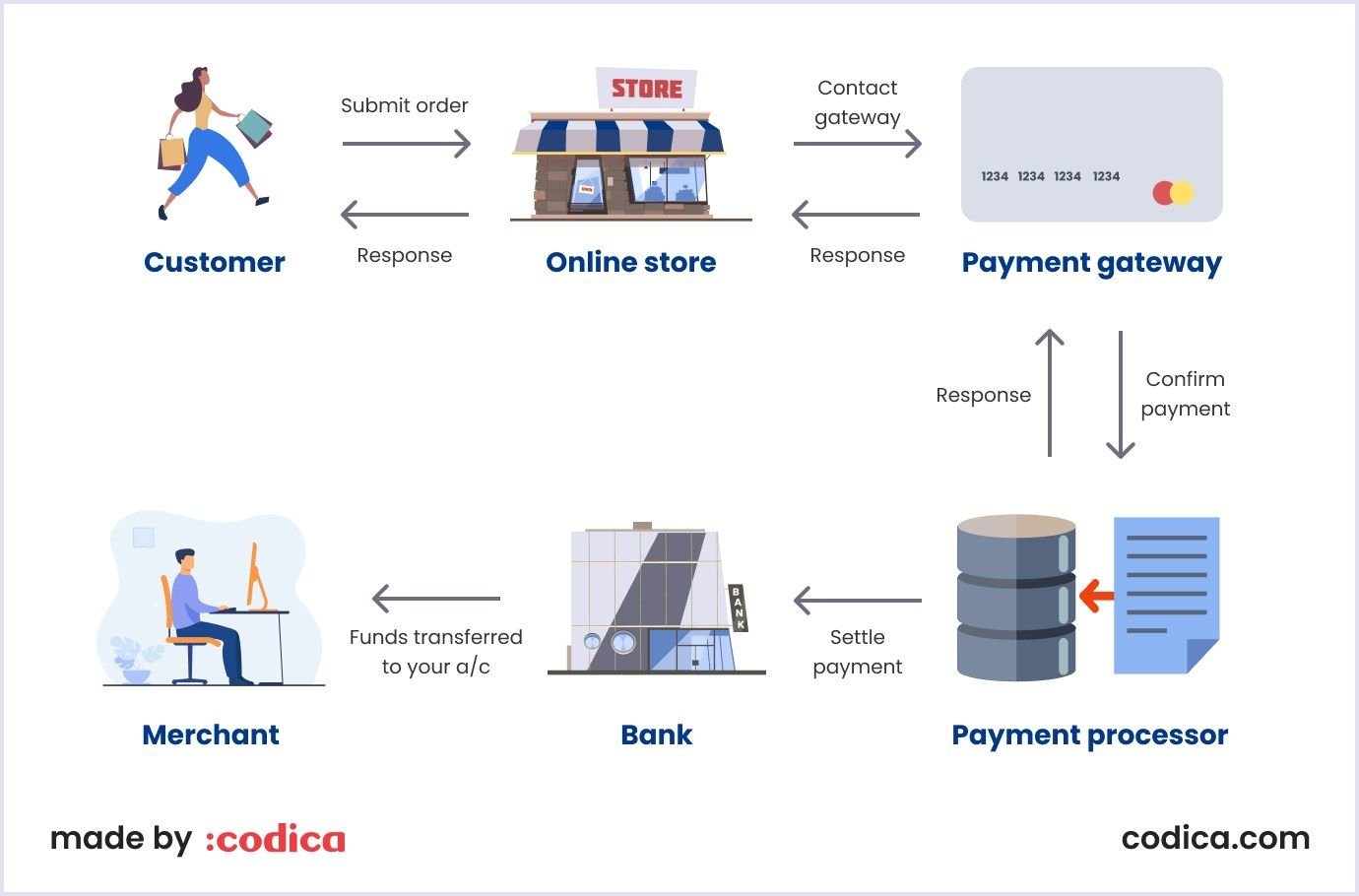

These solutions help you control marketplace payments quickly and conveniently. In general, the work of the gateway is divided into five stages:

- The client enters their payment information (e.g., card number and expiration date).

- An order is formed, and the seller's website sends the information to the payment portal.

- The gateway redirects the request to the company that issued the user’s credit card.

- The gateway receives confirmation of authenticity and authorizes the payment.

- Finally, the ecommerce payment gateway sends the money to the seller.

Payment gateway vs payment processor

How do payment gateway and payment processor differ? Payment gateways capture and transmit credit card information to the payment processor. Additionally, payment gateways handle the crucial task of conveying approval or rejection of transactions.

Meanwhile, ecommerce payment processors work discreetly in the background. A payment processor ensures secure data transfer among various parties until the funds are settled in your bank account.

Thus, payment processors handle the movement of funds between the buyer’s and seller’s accounts. Meanwhile, payment gateways securely transmit payment data for authorization and settlement.

Payment gateways, in collaboration with payment processors, must handle the following challenges:

- Fraud protection;

- Handling multiple marketplace payments;

- Dividing funds between your sellers.

The payment gateway can also require that you or a seller on your marketplace act as a merchant of record (MoR) in transactions. That means you or your seller will assume financial and legal liabilities for managing customer transactions in online sales.

You may also like: Best Monetization Practices to Build a Successful Online Marketplace

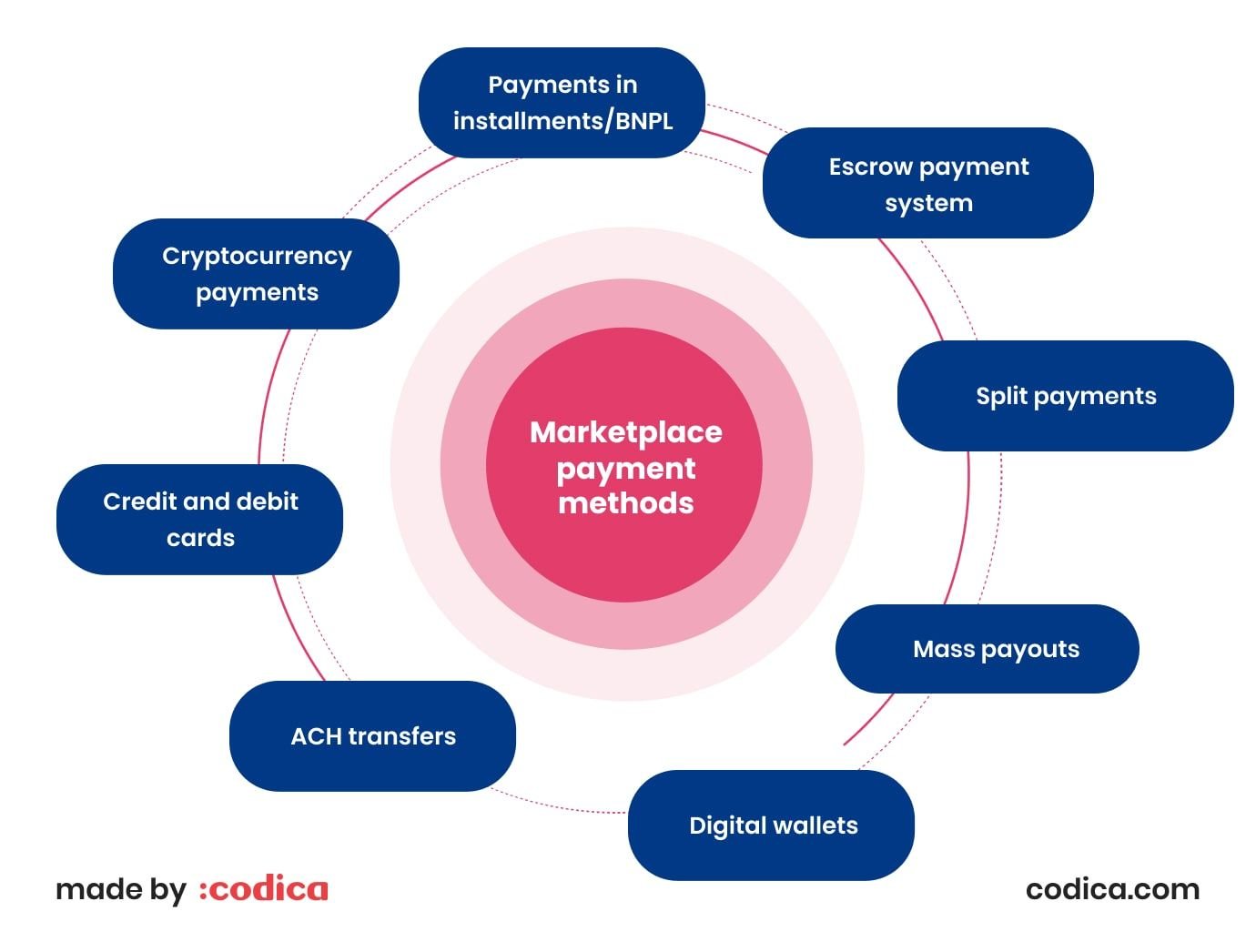

Marketplace payment methods

Choosing a payment method that meets your marketplace’s needs is vital to keeping it running. Ecommerce payment methods ensure smooth and secure operations via your marketplace, making it trustworthy for customers. Let’s look closer at the main payment options marketplaces can use.

Digital wallets

According to Juniper Research, a primary authority on emerging payment technologies, transactions with digital wallets will grow from $10 trillion in 2024 to $17 trillion in 2029. It means a growth rate of 73%.

These services store digital versions of debit and credit cards for making payments. Digital wallet apps are convenient as people can use them on mobile devices. Widely used digital wallets are PayPal, Apple Pay, Google Pay, Amazon Pay, and Alipay.

Credit and debit cards

These ecommerce payment options are standard for marketplaces. You can partner with payment gateways to ensure a stable and secure payment process with credit and debit cards.

Payments in installments/BNPL

This approach enables shoppers to split their payments into parts for specific periods. It is also called Buy Now, Pay Later (BNPL) and can attract customers who cannot pay the total sum upfront.

The BNPL market is expected to grow at a compound annual growth rate (CAGR) of 44.6%, reaching a staggering $1.01 trillion by 2028.

Typically, marketplaces using this approach charge no interest. For example, Zip, a leading fintech, offers BNPL services to prominent stores like Amazon, Target, Walmart, and eBay. Other prominent players in the BNPL sector are Affirm, Sezzle, Klarna, and Shopify’s Shop Pay.

Escrow payment system

This approach helps to retain the transaction amount in the escrow provider while the buyer and seller settle the deal. If a buyer gets a satisfactory product or service, the seller gets the payment. The transactions can vary from tens to thousands and millions of dollars for consumer-to-consumer (C2C), business-to-consumer (B2C), and business-to-business (B2B) marketplaces.

Split payment

It suits multi-vendor marketplaces, providing a place for sales for many sellers. So, it means that shoppers will buy from different vendors. That is why split payments help many vendors. If you work with a payment service provider, they can ensure that the order amount is divided correctly between the sellers.

Mass payout

It is also known as batch or bulk payout. This approach is used when a business pays many contractors, suppliers, or sellers simultaneously. Mass payouts can be used in freelance and ecommerce marketplaces, delivery companies, and subscription-based businesses. Companies use accounting software or integrations to pay in bulk.

ACH transfers

These are bank-to-bank payments processed via an Automated Clearing House (ACH) Network. They are suitable for direct payments between buyers and sellers. For now, ACH transfers are limited to the US only. So, marketplaces working internationally should opt for other payment solutions.

Pay by link

It is a technology where a customer pays via the web link on the phone, chat, or social media. The primary benefit is that customers can pay without using credit card details shared over the phone or in a text message.

Many providers are offering pay-by-link services. Stripe, Adyen, HubSpot Payments, Square, PayPal, and QuickBooks Online offer such payment options.

Payments by QR code

This technology has made a distinguished comeback and is now used in different industries, including online marketplaces. The QR code market is predicted to grow from $2.9 billion in 2023 to $4.8 billion in 2028, with a growth rate of 59%.

QR codes facilitate sales via different channels, such as in-person, online, and social media. Brands benefit from the versatile use cases of this technology, which helps build brand trust and boost conversions.

For example, Levi’s put codes on the tags of actual clothes so shoppers could scan the codes and see available items online, including sizes and colors. Starbucks tracks its customers’ recurring orders, locations, payment methods, and preferences through QR codes. Thus, the company customizes loyalty and rewards programs based on the collected data.

You can also promote user-generated content in your marketplace. For instance, Circle K, a chain of convenience stores, offered free drink fill-ups for a year to a lucky winner who scanned a QR code and left a review.

Cryptocurrency payments

Accepting payments in cryptocurrency is not a widespread practice. Yet, some marketplaces accept Bitcoin and Ethereum as payment methods. For instance, Crypto Emporium, an online retailer, accepts cryptocurrency payments. You can pay for the goods with Bitcoin, Ethereum, Tether, Dogecoin, and others.

Read also: Key Trends in Digital Marketplace Industry in 2025

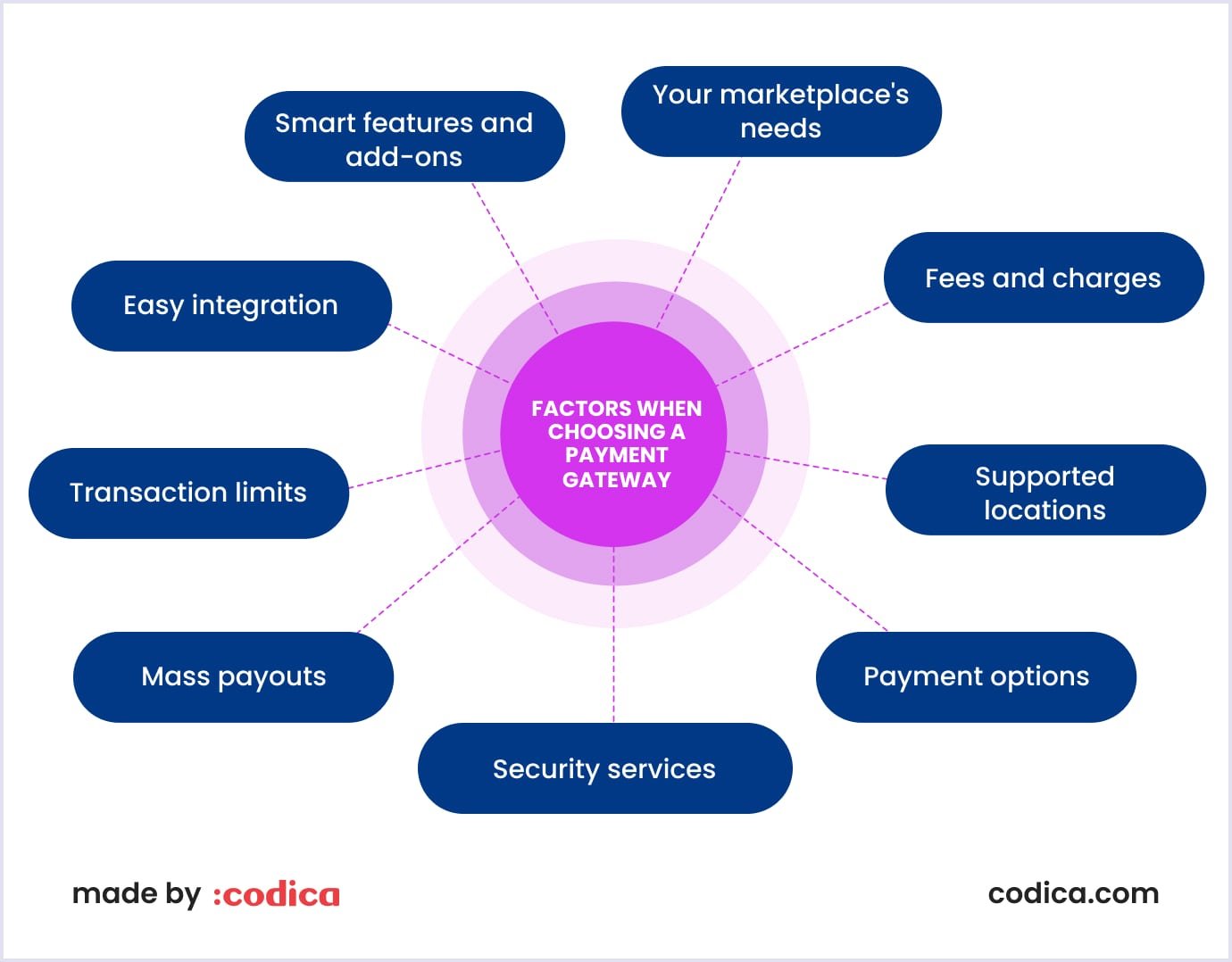

Choosing an ecommerce payment system: factors to consider

The payment gateway should be convenient for marketplace owners and customers. Depending on several criteria, you can choose the best payment option for the services you need. Below, we consider those aspects so you can choose between payment processing companies and meet your marketplace operations. Let’s see what those factors are.

Check your marketplace’s needs

Different types of marketplaces require specific features tailored to their needs. So, the following options can be the basis for choosing a payment gateway:

- Single-vendor or multi-vendor marketplace;

- Need for a mass payout system to pay merchants, creators, or freelancers;

- Collecting a percentage of fees;

- Creating a point of sales integration for in-person sales;

- Handling recurring subscriptions.

Fees and charges

If you integrate a payment gateway into your marketplace, consider the fees and charges collected for using the payment solution. The following are types of commission that payment companies include in their tools:

- Transaction fees;

- Monthly plans;

- Discounts for high payment volumes;

- Charges for currency conversions and international cards;

- Alternative payment methods with cheaper options.

Related reading: How Much Does It Cost to Build a Marketplace Website in 2025?

Supported locations

The most popular payment gateways are available in the US, Canada, Europe, Australia, New Zealand, and Asia. Still, particular payment gateway providers do not offer services in certain regions. For example, the following geo-restrictions apply:

- Stripe supports Indonesia with invite-only;

- Dwolla is available only in the US;

- PayPal supports the US, Canada, Europe, Australia, New Zealand, and some Asian countries.

You can use a workaround to go beyond limitations and implement Visa or MasterCard payments available globally.

Number of payment options

A third-party website needs to support the payment method to ensure your customers can finish their purchases. It is better to have many payment options than fewer to help your customers with their transactions. Popular ecommerce payment methods used online include the following:

- PayPal, PayPal Credit;

- Venmo;

- Google Pay;

- Apple Pay;

- Visa;

- ACH;

- Digital wallets.

There are popular cards that marketplaces can accept, such as:

- Visa;

- Mastercard;

- American Express;

- Union Pay;

- Maestro;

- JCB;

- Discover;

- Carte Bancaire;

- Diners Club.

Certain payment methods are available in specific countries, so you can also check them out. For example, iDEAL is widely used in the Netherlands, Giropay works in North America and Europe, and Konbini operates in Japan.

Popular platforms also support cryptocurrency transactions. Exploring this type of payment can open new revenue opportunities in your marketplace. For example, Stripe and PayPal offer such services.

Security standards and services

When handling credit data in your marketplace, complying with industry standards is essential to protect sensitive information and prevent fraud. Here’s how your platform can enhance security while meeting compliance requirements:

- PCI DSS. Marketplaces using credit data must comply with PCI DSS (Payment Card Industry Data Security Standard). It protects credit card numbers, expiration dates, and security codes;

- Payment processors. Using them simplifies compliance thanks to integrations for checkout pages. Payment processors ensure that sensitive data bypass the marketplace website and go directly to secure servers;

- 3-D Secure. This feature provides additional verification via the issuing bank’s website and a code sent to the cardholder’s phone;

- Know Your Customer. The technology provides client identity checks. So you can prevent unlawful operations with money in your marketplace.

At Codica, we keep a vigilant eye on security and continuous app operation. Thanks to robust DevOps services and solutions, our platforms and apps work smoothly and provide the best user experience.

Mass payouts

This technology allows for multiple payments at once. It best serves multi-vendor marketplaces when an owner pays multiple sellers. Also, you reduce errors and save time.

Transaction limits

Payment platforms typically set maximum transaction limits. Also, remember to check if there are minimum amounts for transactions. If you are not sure, contact the payment platform’s support.

Payment gateway integration

Companies offering ecommerce payment gateways should provide plugins or other means to integrate with existing e-commerce solutions. Integrations should be easy and secure.

If you want to create a custom integration, the payment platform should provide relevant documentation and support for developers.

Smart functionality and add-ons

It is convenient if a payment gateway provides features for better productivity. For example, Stripe Tax is a feature that allows marketplaces to calculate, collect, and report taxes.

Chargebacks and refunds are also significant for marketplaces. The platform should ensure easy settlements for processing canceled payments.

Further reading: B2C Ecommerce Marketplaces: All You Should Know Before Building One

The best payment gateways for two-sided marketplaces

In the realm of two-sided marketplaces, selecting the best payment gateway hinges on several factors. These aspects encompass distinct prerequisites, geographical location, and the target audience. Below, we present a collection of well-regarded ecommerce payment solutions.

Stripe Connect

Source: Stripe

Stripe is one of the well-known ecommerce payment providers for individuals and different-sized businesses. For now, it supports online payments in 46 countries. Stripe Connect powers ecommerce payment processing on two-sided marketplaces and crowdfunding platforms.

Stripe has the most straightforward merchant onboarding compared to other payment methods for marketplaces. Your sellers just need to connect their accounts to your marketplace to start. It also provides split marketplace payments and allows you to set a service fee for each sale. Beyond that, your vendors can act as MoR, which improves payment security.

Furthermore, Stripe allows each seller to customize an invoice depending on the consumer and adapt it to a specific brand.

Stripe Connect comes with a wide range of benefits:

- Support for 135+ currencies;

- Multiple payment acceptance;

- High-level security compliant with Payment Card Industry Data Security Standard (PCI DSS) (+ Stripe’s original tool, Radar);

- Developer-friendly documentation and clean API;

- Quick onboarding for merchants;

- Dashboard for management to control your business.

Although Stripe is expanding, now it’s focused on the Western world. It handles payments mainly in the USA, Australia, and Western Europe. You can check if it’s already available in your region on Stripe's official website.

The marketplace businesses using Stripe Connect include Lyft, Kickstarter, and Booking.com. Expanding internationally, these online businesses faced difficulties with local regulatory compliance. Stripe Connect was just the marketplace payment solution that handled that well.

At Codica, we also use Stripe in marketplace development. For example, recently, we developed a marketplace for caravans. It is an Australia-based project intended for camper fans to sell or buy new or utilized recreational vehicles.

Below, you can see a short overview of this caravan-selling website project. Here, we show the process of using it.

Using the latest techniques, we provided our client with an efficient, user-friendly, and modern web solution. Our developers chose Stripe for this platform for fast, secure, and simple marketplace payments.

Braintree

Braintree is a payment software provider for ecommerce platforms and mobile apps. It offers processing payments in 45+ countries. It is pretty competitive among other payment solutions for online marketplace businesses.

Braintree supports split payments, which is a helpful option if you want to build a two-sided marketplace. It divides your merchant payments and automatically sends a commission fee to a marketplace owner. It’s also good news that your vendors can perform as MoR in transactions.

Braintree provides your platform with the following benefits:

- Support for 130+ currencies;

- Multiple payment acceptance;

- Advanced SDK (software development kit) features (Drop-in and Custom-UI integration options);

- High-level security compliant with PCI DSS;

- Braintree’s fraud management tools.

Currently, the payment gateway supports the United States, Canada, Australia, Europe, Singapore, Hong Kong, Malaysia, and New Zealand. So, registration in these countries is required for using Braintree.

Some of the marketplace businesses using the Braintree provider are Hotel Tonight, Poshmark, and Trouva. Targeting mobile-first users, they sought safety and a great customer experience. With excellent SDK features and advanced protection, Braintree could meet the payment needs of these companies.

Read also: 11 Main Integrations That Every Marketplace Needs

Dwolla

Dwolla is a payment processor used in mobile platforms and e-commerce marketplace development. It offers advanced Automated Clearing House (ACH) - a payment solution for American marketplaces. An ACH is an electronic system that entities use for managing banking transactions.

This online payment gateway handles two-sided marketplace payments, facilitating the participants' fund flow. In other words, it combines pay-in (funds going from customers) and pay-out (funds going to vendors) flows to undertake a transaction. Acting as a money transmitter, marketplace owners get their service fee.

It’s worth noting that with this payment solution, a marketplace owner needs to be an MoR and assume all the related responsibilities.

This gateway provides marketplace payments with such crucial features:

- Support for ACH direct bank transfer in US dollars;

- Automated mass payments;

- Developer-friendly documentation and clean API;

- High-level security compliant with PCI DSS.

Among other popular payment gateways for online marketplaces, this one has the tightest location focus on the US market. To use it, all three parties must be registered in the United States.

Some of the marketplaces using this payment solution are GOAT, Nomad Health, and Tophatter. Scaling up, these ecommerce platforms needed to simplify and speed up their marketplace payouts. The Dwolla payment gateway helped them to address this challenge through ACH-optimized APIs.

PayPal Commerce Platform

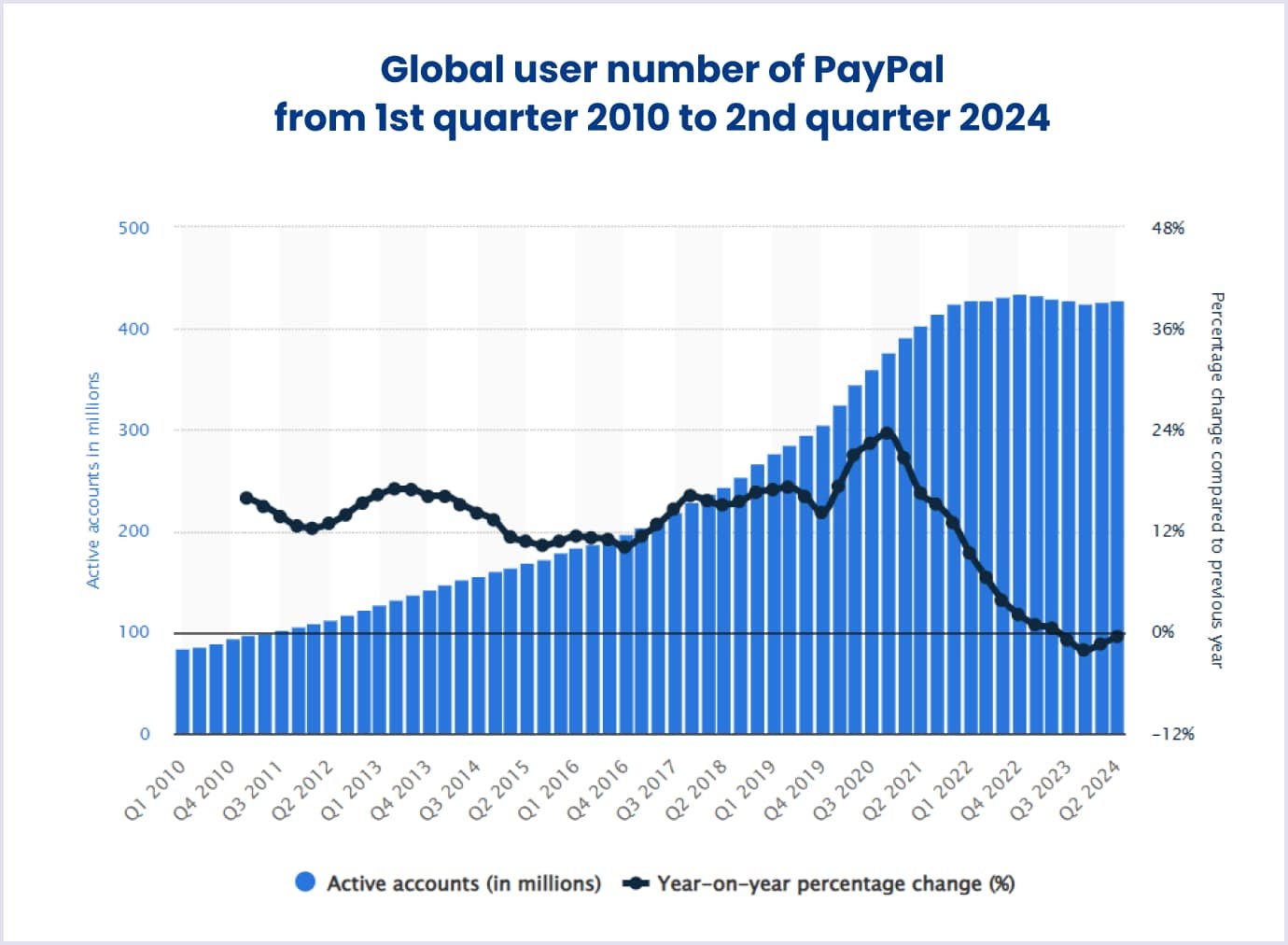

The PayPal company is the oldest and most popular payment provider that started in 1998. For now, it has over 431 million users in 202+ countries. It means that you will get access to a great audience of shoppers.

Source: Statista.com

PayPal has its marketplace payment solution known as PayPal Commerce Platform. It offers unique features for two-sided marketplace payments. You can opt for Managed or Connected integration paths according to your needs.

With the Managed path, you act as a Merchant of Record (MoR) and control the dividing of funds among your vendors. With the Connected path, PayPal splits payments and enables your merchants to be MoRs. Yet, to use it, your merchants are bound to have PayPal Business accounts.

So, compared to other payment gateways for marketplaces, now it has a limited option to select partners only.

Other PayPal Commerce Platform’s main features include the following:

- Support bank transfers in 100+ currencies;

- Multiple payment acceptance;

- High-level security compliant with PCI DSS, including 3-D Secure 2.2;

- Support for split and mass payments.

Marketplaces using PayPal include such brands as Grailed, iFundWomen, and Replin. Entering new markets, these companies aimed for a secure and reliable marketplace payment portal. Being famous and trusted worldwide, PayPal happened to be ideal for them.

We used PayPal when developing the first automotive marketplace in Africa. This solution covers various regions of Africa and connects shoppers with private sellers and dealers. On this platform, users can easily purchase or sell autos, motorbikes, and trucks.

By the way, you can watch a short video below to understand how this solution works.

To provide maximum security for online buyers, we integrated the PayPal payment method into this project. Also, we can build a custom payment solution for your needs. You will get a smooth and robust solution thanks to the optimized tech stack and our quality assurance services.

You can also see other successfully delivered case studies in our portfolio to learn more.

Mangopay

Source: Mangopay

Mangopay is a comprehensive ecommerce payment system for crowdfunding, fintech platforms, and marketplaces. Unlike other traditional payment solutions, Mangopay delivers its users with a convenient API.

Also, the payment gateway offers a white-label solution. A white label is a partnership in which one company launches a product, and another sells it under its brand. Mangopay's marketplace payment solution may be easily integrated into users' designs.

This marketplace payment platform accepts multiple currencies and online payment methods. Furthermore, it stores funds in segregated accounts and automates payouts.

The Mangopay ecommerce payment gateway provides your platform with the following advantages:

- Practical and accessible dashboard to manage your business;

- White-label solution to set e-wallets;

- Multiple payment acceptance;

- Clean and developer-friendly API;

- High-level security compliant with PCI DSS, PSD2 (the revised Payment Services Directive 2), GDPR (General Data Protection Regulation), and 3-D Secure.

Mangopay provides payment gateway services for global and leading European marketplaces. They are Vinted, Leetchi, Chrono24, Wallapop, La Redoute, Rakuten, and others.

Adyen

Source: Adyen

Adyen is one of the popular payment gateway providers. It was launched in 2006. Since then, this payment tool has become one of the most popular service-oriented payment gateways. Adyen can be characterized as a flexible, functional, and safe payment tool. It provides a standardized customer experience and is available in 18 European countries. Moreover, this tool is available in Brazil, Mexico, China, and Southeast Asia.

Adyen secures customers with the embedded RevenueProtect solution. This risk management toolkit is effective against fraudsters. RevenueProtect keeps customers’ credit card info safe.

Adyen provides marketplace payments with such important features:

- Support of payments in 37 currencies, including payouts, bank transfers, and more;

- Free of monthly fees, payment gateway integration, setup, or closure charges;

- Multiple payment methods;

- Smooth onboarding process for new users;

- High-level security compliant with PCI DSS;

- RevenueProtect tool to secure transactions, reduce costs, and build trust.

Popular marketplaces that use Adyen include such giants as Uber, eBay, Etsy, and many others. This tool is also well-suited for small businesses thanks to the security and optimization tools, plus setup and zero monthly fee.

Exactly

Source: Exactly

This ecommerce payment gateway provides a complete set of features for payment processing. Exactly offers API integration and hosted pages for one-day payouts. The provider suggests global acquiring, a payment gateway, as well as mass and recurring payment processing. Businesses also benefit from chargeback and dispute resolution options.

Exactly applies high-security standards, such as Know Your Customer, 3D Secure, tokenization, ML-empowered analytics, and more.

The payment system operates with over 150+ currencies, 21 payment methods, and the necessary supporting integrations for ecommerce payment processing.

The provider suggests various payment methods with the following features:

- Flexible pricing plans;

- Easy setup;

- Anti-fraud systems;

- Integration with major content management systems;

- PCI DSS compliance and SSL data encryption.

Besides payment gateway services, the company offers convenient dashboards that give insights into their customers’ ecommerce businesses.

You may also like: How to Create an Online Service Marketplace: Ultimate Guide

Choosing the right payment solution for an online marketplace

You should pay attention to the following steps to choose the right marketplace payment gateway:

- Verify if it supports payments in your region. Now, PayPal, Stripe, Adyen, Exactly, and Mangopay are more flexible. They have global coverage for partners. In turn, Braintree and Dwolla are suitable for US marketplaces.

- Check international marketplaces’ support (if it’s necessary for you). Stripe, Adyen, Mangopay, and PayPal fit if your sellers and buyers live in different countries.

- Opt for your appropriate MoR strategy. In this view, with Dwolla, you, as a marketplace owner, will be a Merchant of Record. Braintree, Mangopay, Adyen, and Stripe allow your sellers to be legally responsible for transactions. Finally, PayPal offers you both options to integrate.

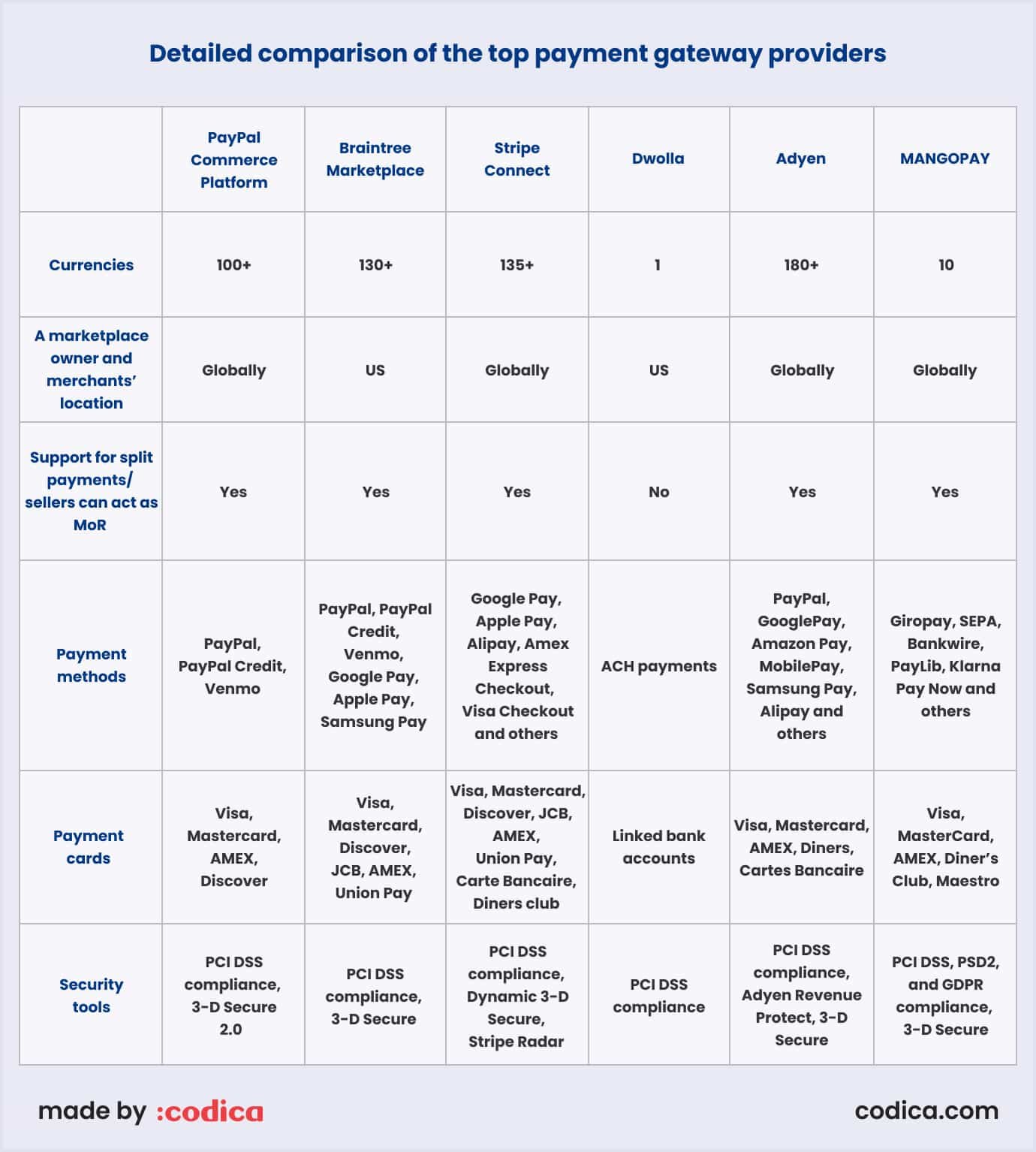

We have prepared a detailed comparison table below. Here, we consider the main features of the above-discussed marketplace payment methods. So, you can choose the best ecommerce payment systems when preparing to employ a multi-vendor marketplace development service.

Blockchain payment solutions

Cryptocurrency gateways enable enterprises to accept transactions of cryptocurrencies as payments from customers. These currencies are paid for goods or services.

Below, we’ll consider a few options for marketplaces that want to integrate the latest alternative payment technology.

Coinbase Commerce

Source: Coinbase

Coinbase Commerce is a cryptocurrency web payment service for businesses. It was launched by Coinbase, the largest US cryptocurrency exchange. This payment service aims to make digital currency transactions easier for businesses, using advanced technologies like custom enterprise software development. In short, this marketplace payment solution allows enterprises to accept cryptocurrencies. They include Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), USD Coin (USDC), Bitcoin Cash (BCH), and Dai (DAI).

Coinbase is similar to Stripe and Paypal. Why? The payment gateway also offers one essential service and then introduces more products with different price types.

For example, Coinbase Commerce allows its clients to open trading accounts. Customers also can integrate their account information into their platform. Also, this payment system enables users to optimize the process of verifying the cryptocurrency.

The Coinbase Commerce software platform has many features, but let's see its main benefits:

- Convenient dashboard to control your business;

- Low-cost transaction fees;

- Extremely secure data encryption;

- Immediate release of payments;

- Exchange accounts are available in 100+ countries.

Coinbase Commerce is used by many marketplace businesses. They include Chess.com, Picoworkers.com, and more.

BitPay

Source: BitPay

BitPay is the greatest Bitcoin payment service provider. It allows vendors to take BTC as marketplace payment. Unlike most other payment processing companies, BitPay charges a low fee for processing transactions and converts them to fiat. Fiat is any currency created and regulated by the government (dollars, euros, and so on).

All buyers have to do is select cryptocurrencies as a payment method with suppliers that support BitPay and then pay the bill from their digital wallets.

The BitPay payment gateway accepts various cryptocurrencies. They are Bitcoin Cash (BCH), Dogecoin (DOGE), Wrapped Bitcoin (WBTC), Ethereum (ETH), Litecoin (LTC), and Shiba Inu (SHIB). Moreover, BitPay supports five stablecoins (USDC, GUSD, USDP, BUSD, and DAI).

BitPay marketplace payment system has the following pros:

- Secure money transfers;

- Good exchange rates;

- The ability for users to shop with Mastercard;

- Low transaction fee.

BitPay has an impressive list of marketplace businesses using it, including Newegg. With the help of BitPay, they provide their solutions with powerful tools for crypto spending and acceptance.

Mobile payment solutions

Google Pay and Apple Pay are two widely used mobile payment technologies, particularly in online marketplaces.

They ensure a secure and straightforward way to pay for services or items. Thus, users can securely and quickly provide their shipping, payment, and contact information to confirm the order. So, you can integrate these two technologies in mobile app development.

Apple Pay

Source: Apple Pay

Apple Pay first appeared in 2014 in the US. It's a simple, secure, and private way to pay in apps, stores, and online. It is compatible with iPads, iPhones, Mac computers, and Apple Watches.

Users can make payments through the Apple Pay gateway in Safari or directly within apps that support it. Transactions are secured by advanced hardware and software features, ensuring user data remains private.

Notably, Apple does not access or store the original debit, prepaid, or credit card numbers added to Apple Pay. Apple also does not collect any information that can identify users.

The Apple Pay payment gateway comes with the following benefits:

- Enabled by NFC (near-field communication);

- Face ID and Touch ID for secure authentication;

- Accepted in over 80 countries and regions worldwide;

- Robust security and privacy policies.

Amazon, Etsy, eBay, and many other marketplace businesses use Apple Pay to enhance shopping experience. Its convenience and security make it an ideal payment solution for both customers and marketplace owners.

You may also like: How to Build an Online Marketplace: 17 Tips for Aspiring Entrepreneurs

Google Pay

Source: Google Pay

Google Pay, formerly Android Pay, lets users shop and transfer money. To pay with it, users need to create a Google account.

Google Pay is built with advanced security layers to protect users' funds and sensitive data. Credit card numbers are neither stored on the device nor shared with merchants, ensuring maximum privacy.

Other Google Pay’s benefits include:

- NFC-enabled;

- Free for both vendors and customers;

- Clean and developer-friendly API;

- Quality customer support.

Major companies like eBay, Etsy, and many other thriving businesses have adopted Google Pay for its security, ease of use, and customer trust.

Apple Pay vs Google Pay

Both Apple Pay and Google Pay are convenient and secure ways to make payments via mobile devices, whether shopping in-store or online.

Key similarities:

- Both offer a simple and fast checkout process;

- Each supports contactless payments, enhancing convenience for users.

Differences:

- Apple Pay is optimized for iPhones, iPads, Macs, and Apple Watches;

- Google Pay caters primarily to Android devices, though it is also available on some web platforms and iOS;

- While Apple Pay excels in its simplicity and user-friendly design, Google Pay offers additional functionalities, such as peer-to-peer money transfers and integration with Google services.

Recommended reading: How to Build a Multi-Vendor Marketplace Platform From Scratch

Summing up: grow your business with top payment solutions

Now, you know the best online marketplace payment options. They offer seamless security and advanced features for payment processing. Here is a quick recap for you.

Braintree and Dwolla could be great for you if you have a US-oriented platform. Stripe, Mangopay, Adyen, Exactly, and PayPal are gateways best suited for international online trading. Coinbase Commerce and BitPay help to accept payments and trade cryptocurrencies securely. Apple Pay and Google Pay are some of the best NFC services that work globally.

The choice of payment solutions for marketplace businesses is crucial. However, it is not the only factor you need to consider when you start an online marketplace website. One of the most important factors is having a reliable and experienced development partner.

If you need any help with online marketplace development, Codica is ready to transform your ideas into reality. Contact us to discuss them right now!