An online marketplace is a platform where you can buy products or services using the Internet and your computer or mobile device. They are convenient because they work for different time zones and audiences. From niche marketplaces to one-stop-shop giants like Amazon, Etsy, eBay, and Walmart, marketplaces quickly provide products and services to wide audiences.

Nevertheless, if you want your online marketplace to succeed, you should focus on key metrics. Customer acquisition cost, average order value, and other enterprise and startup marketplace metrics outline your success, opportunities, and challenges. Thus, you can drive your marketplace in the right direction.

Our experts know how to build online marketplaces and share their experience on metrics to track your business results. We cover the key marketplace metrics so you can make data-driven decisions. Let’s dive into it.

Essential marketplace metrics for overall health monitoring

Gross merchandise value (GMV)

This measure represents the total value of goods and services sold through the marketplace in a certain time frame. It is one of the most important metrics for marketplaces and is typically measured quarterly or yearly. GMV is calculated before accrued costs, such as marketing, merchandising, delivery, discounts, and returns, are deducted.

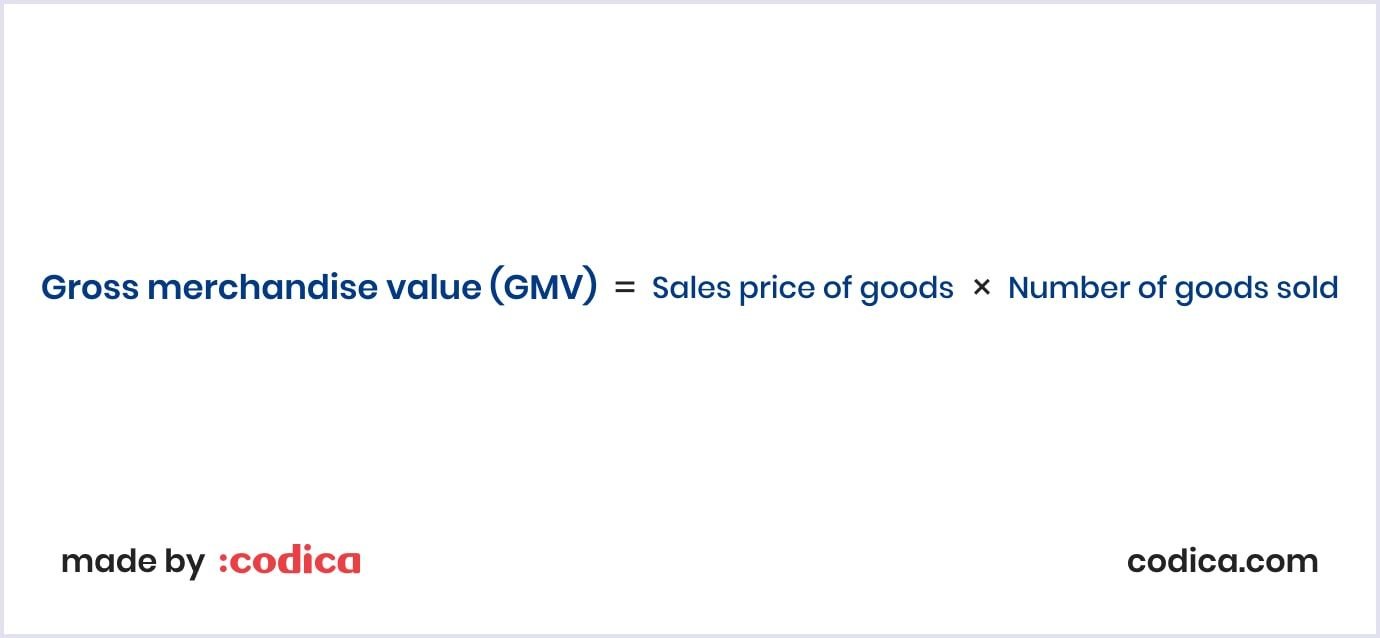

GMV can be calculated in different ways. The most common formula used is as follows:

Significance of GMV as a measure of marketplace activity and growth

GMV is used mostly by ecommerce businesses and functions primarily as a comparative financial metric. You can review total sales records from one period to total sales records from another period. Ultimately, the metric is designed to help you put your sales on growth.

The common mistake of using this metric among companies was paying attention to it alone. Now, it is clear that GMV must be measured with a view of other parameters, such as net revenue, take rate, and customer lifetime value. For example, you might pay attention to your pricing or cost management if you get a high GMV and low net revenue.

Net revenue

This metric is also often referred to as net sales. It is the total amount of revenue generated by your daily transactions. You can calculate net revenue as your total revenue minus your costs. Such costs include discounts, refunds, payment processing fees, returns, and other applicable costs.

Importance of net revenue as a measure of marketplace profitability

Unlike GMV, net revenue shows transaction value with deducted costs. So, net revenue gives a clearer picture of the marketplace’s business health. If the net revenue exceeds operating costs, the marketplace is profitable. By analyzing the net revenue metric, you can understand how to adjust your fees, discounts, and other costs.

Moreover, if you seek investments, this metric is key to highlighting the state of your marketplace to investors.

Take rate

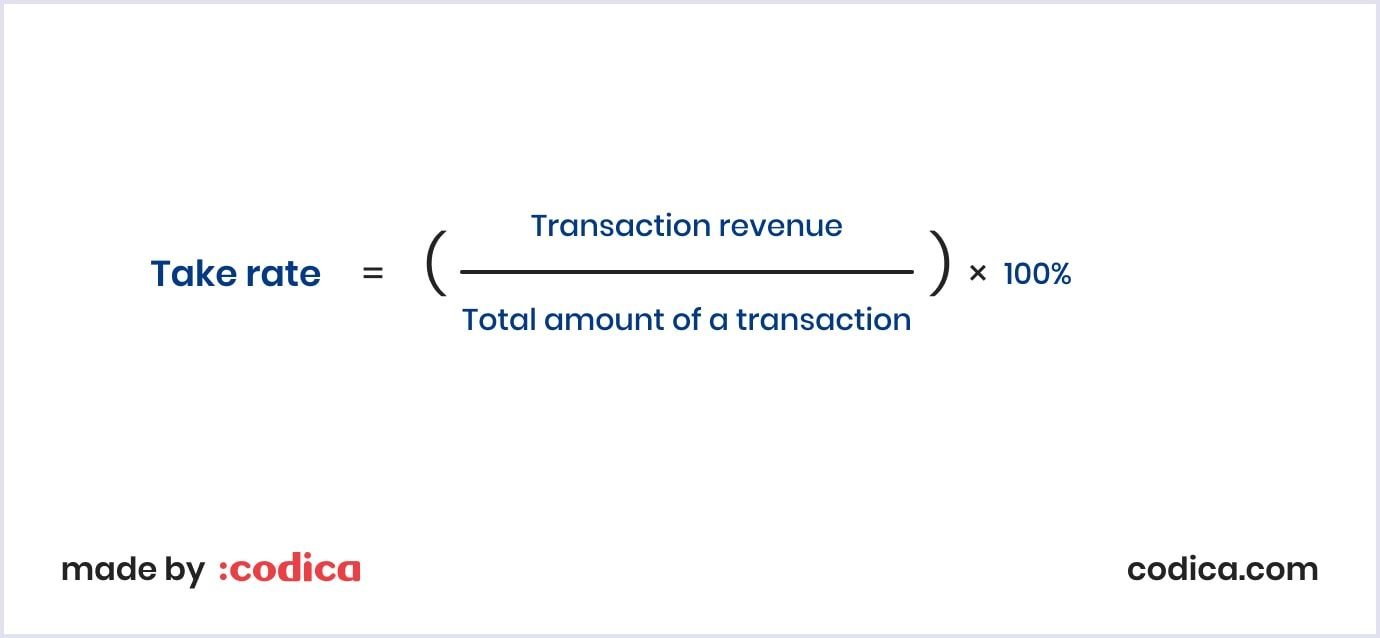

As an important marketplace metric, take rate is a share a marketplace keeps as revenue while enabling transactions. Typically, it is a percentage of gross merchandise value and makes between 10% and 30%. Take rate is calculated before deductions with the following formula:

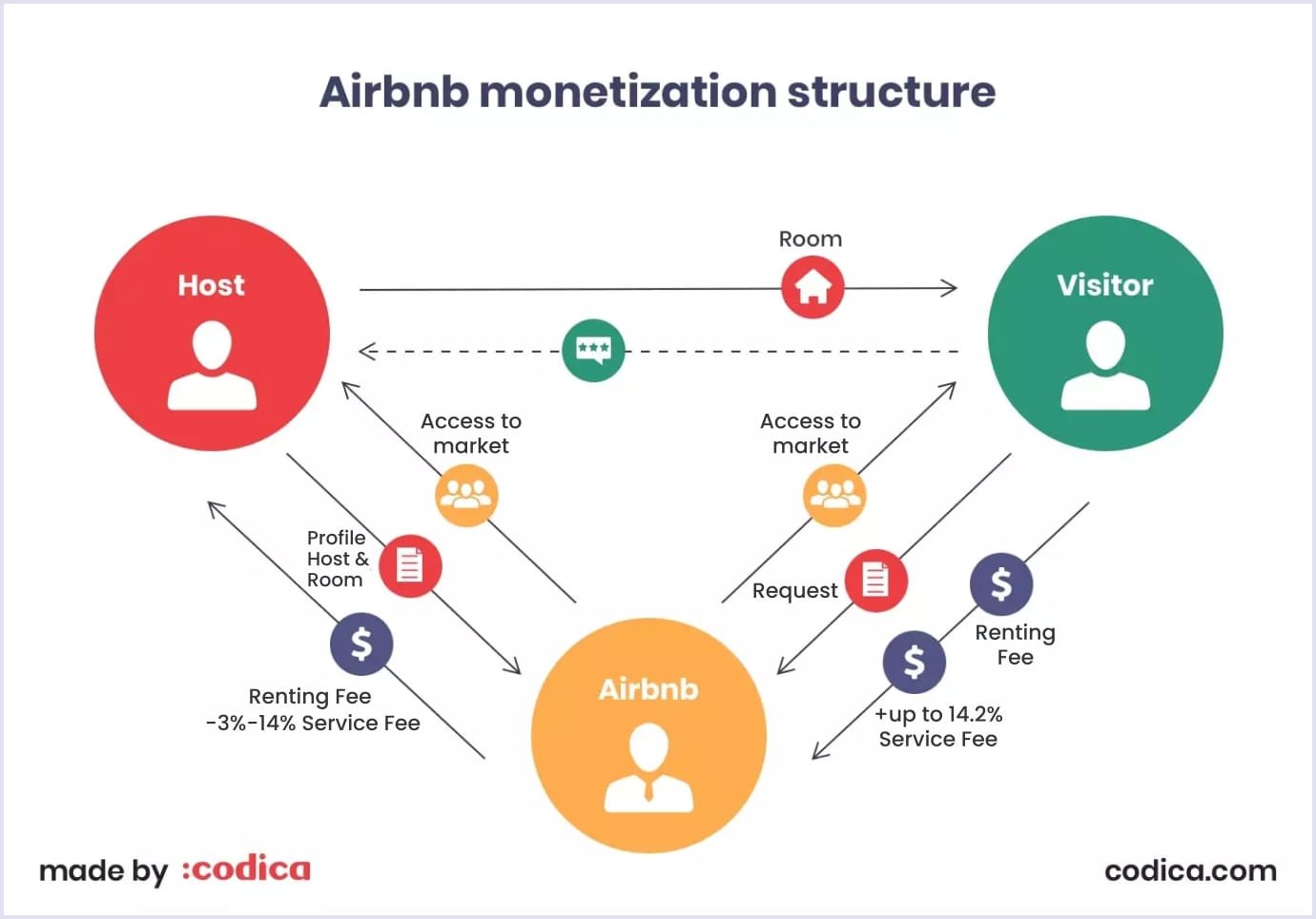

Platforms that offer small services, such as Uber or Lyft, charge a lower take rate. Meanwhile, more expensive services come with a higher take rate. For example, Airbnb charges up to a 14.2% take rate for luxury stays.

Significance of take rate as a measure of marketplace efficiency and profitability

The take rate should be proportionate to the value you provide to your customers. So, apply a low take rate for small services and a higher rate for wholesale or other costly services and transactions. Reviewing this metric from competitor marketplaces can help you reshape your revenue model and pricing strategy.

Metrics to gauge customer acquisition and retention

Customer acquisition cost (CAC)

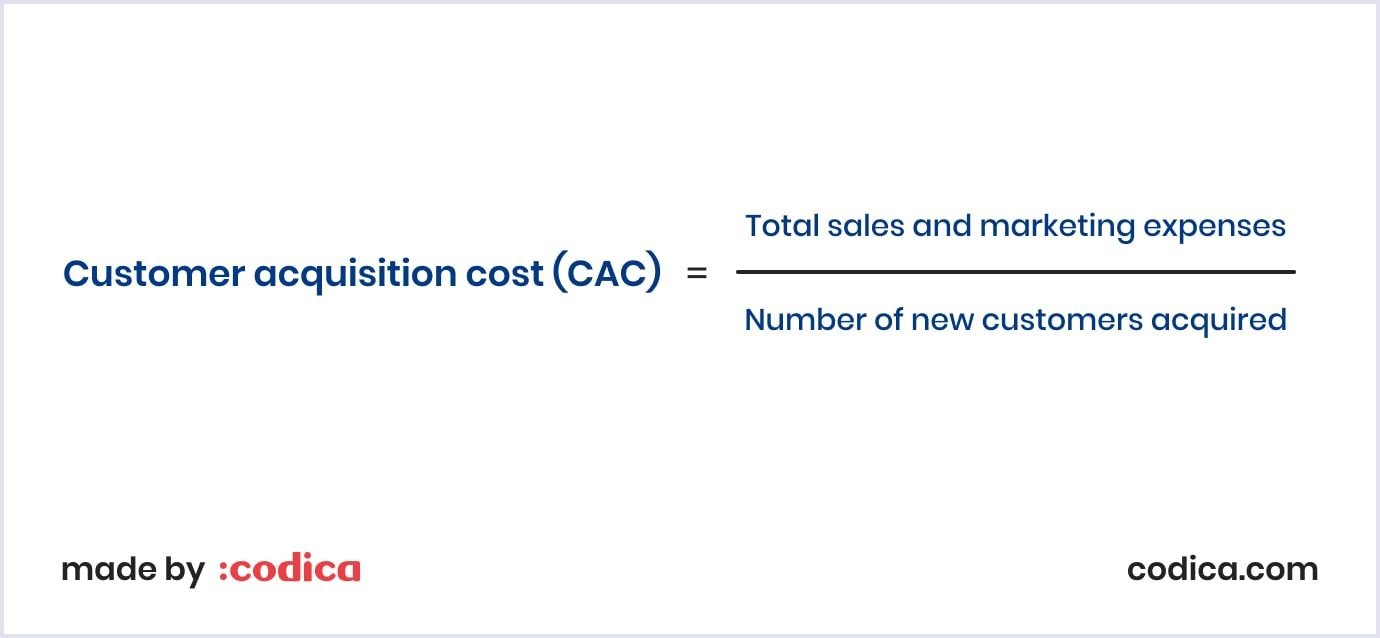

This online marketplace metric shows how much you spend to acquire a new customer. In terms of a marketplace, CAC is calculated by dividing the entire amount spent on operations, sales, and marketing by the total number of new consumers who joined or made purchases via your platform.

Importance of CAC in evaluating marketing and sales effectiveness

CAC shows the success of your marketing and sales efforts and the efficiency of your operational costs. In ecommerce, normal CAC makes around $81-$87. So, if you have higher numbers, reconsider your pricing strategy and budget planning.

Cutting marketing costs to improve your financial stand is also not a solution. You still need qualitative customers who will be loyal to your brand. So, finding a balance between spending and cutting is crucial.

Customer lifetime value (CLTV)

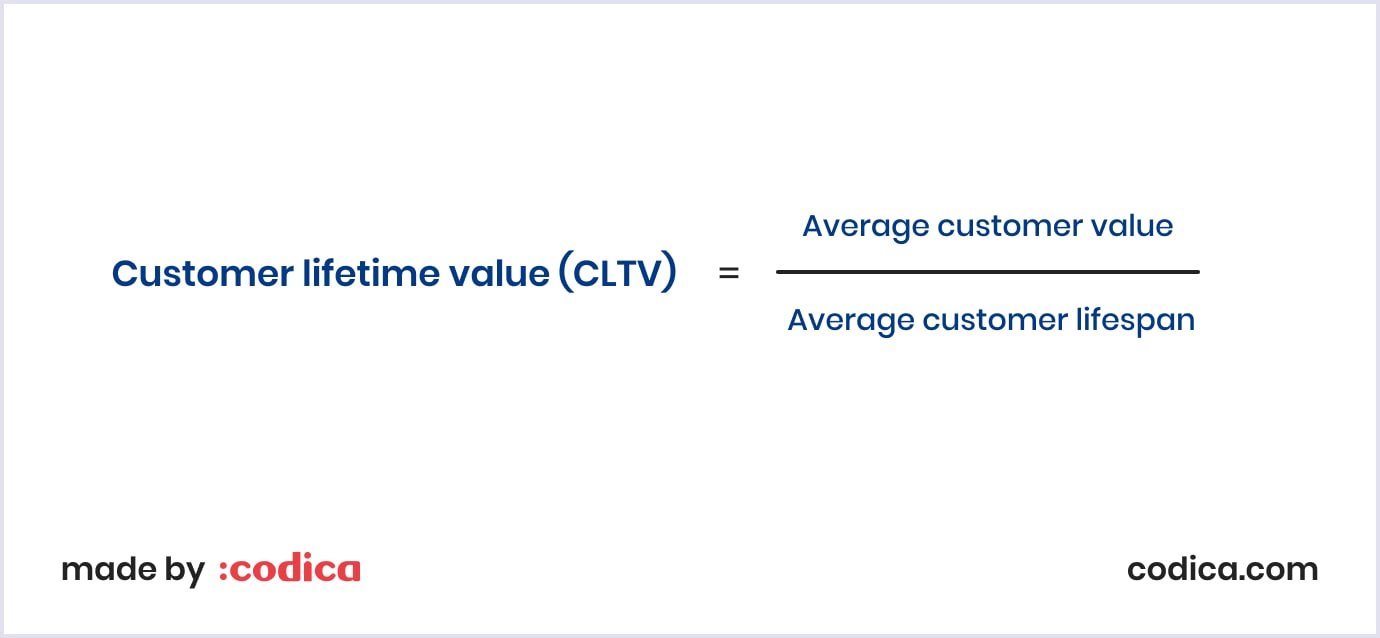

This metric helps you understand what net revenue you will get from customers throughout your relationship. CTLV is a comprehensive metric that will help you get a holistic measurement that includes gross margin and the relationship timeframe. To calculate CLTV, use the formula below:

Significance of CLTV in assessing customer profitability and long-term growth

CLTV gives insights that help you plan your marketing strategy and predict revenue. This is vital for your marketplace to evolve and your planning investment. If your CLTV needs improvement, consider enhancing your customer experience with your marketplace. Check your website for responsiveness, engaging interface, and accessibility. Also, provide personalized features and experiences to engage your customers more.

Active users

In the marketplace field, active users engage with your marketplace through browsing lists, leaving reviews, and interacting with others. You can check them in your analytics tools for a specific period of time, like daily (DAU), monthly (MAU), and yearly active users.

Importance of active users as a measure of marketplace engagement and retention

The marketplace provides value, builds trust, and promotes repeat visits. It is critical for long-term success based on many active users. Active user metrics also facilitate the discovery of user activity patterns, enabling data-driven choices, optimizing marketplace features, and improving user experience.

Moreover, the longer active users stay and engage with your platform, the more trustworthy it is. Active users also indicate that your user acquisition and retention strategy is efficient.

Metrics to assess marketplace efficiency and liquidity

Conversion rate

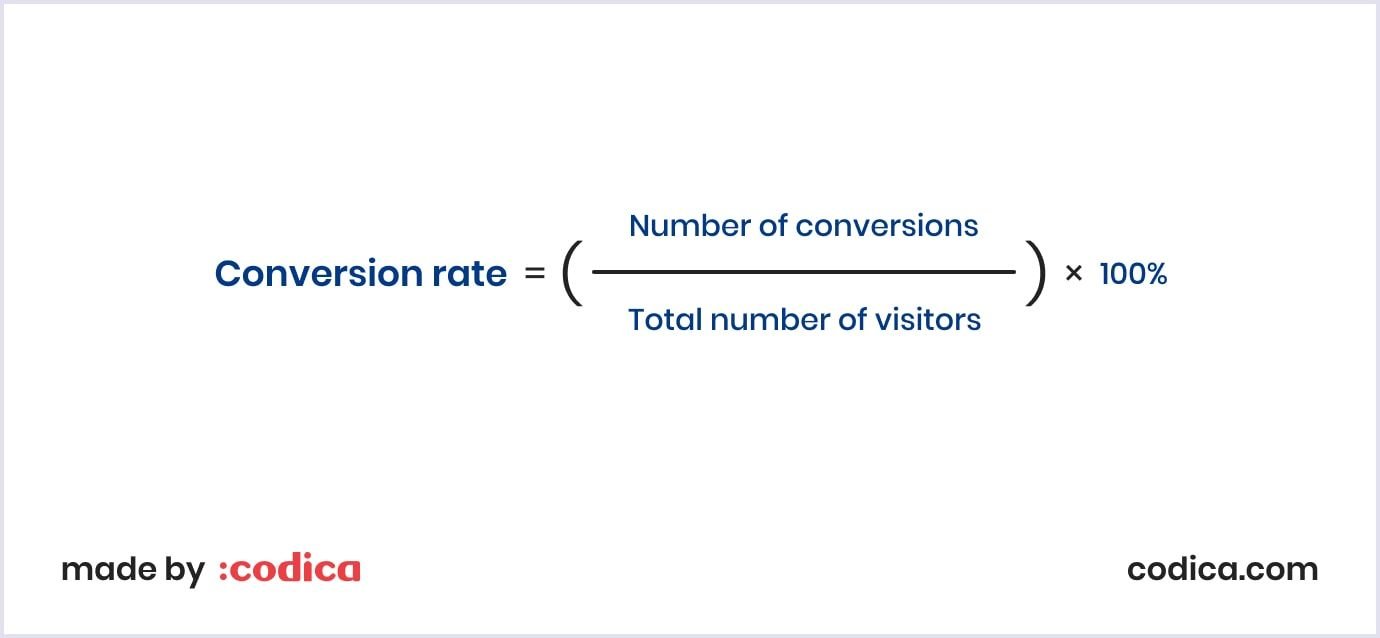

This metric shows the percentage of visitors to your marketplace who performed the desired action. For example, the conversion rate grows when visitors purchase, create a listing, or sign up for your service.

Use the following formula to get the conversion rate:

Significance of conversion rate in measuring marketplace effectiveness

Conversion rate is a marketplace success metric that shows the efficiency of your value proposition, user engagement, and overall experience with your platform. A high conversion rate transforms into better business performance, more transactions, and higher revenue. If you see positive conversion dynamics upon specific marketing strategies, you can expand them to improve your results even more.

On the other hand, a low conversion rate outlines problem areas for you to solve. Addressing them will help you improve your conversion rate and bring more transactions to your marketplace. Pay attention to how users interact with your platform. Those behavioral cues will help you fortify user engagement and strengthen your marketplace’s performance.

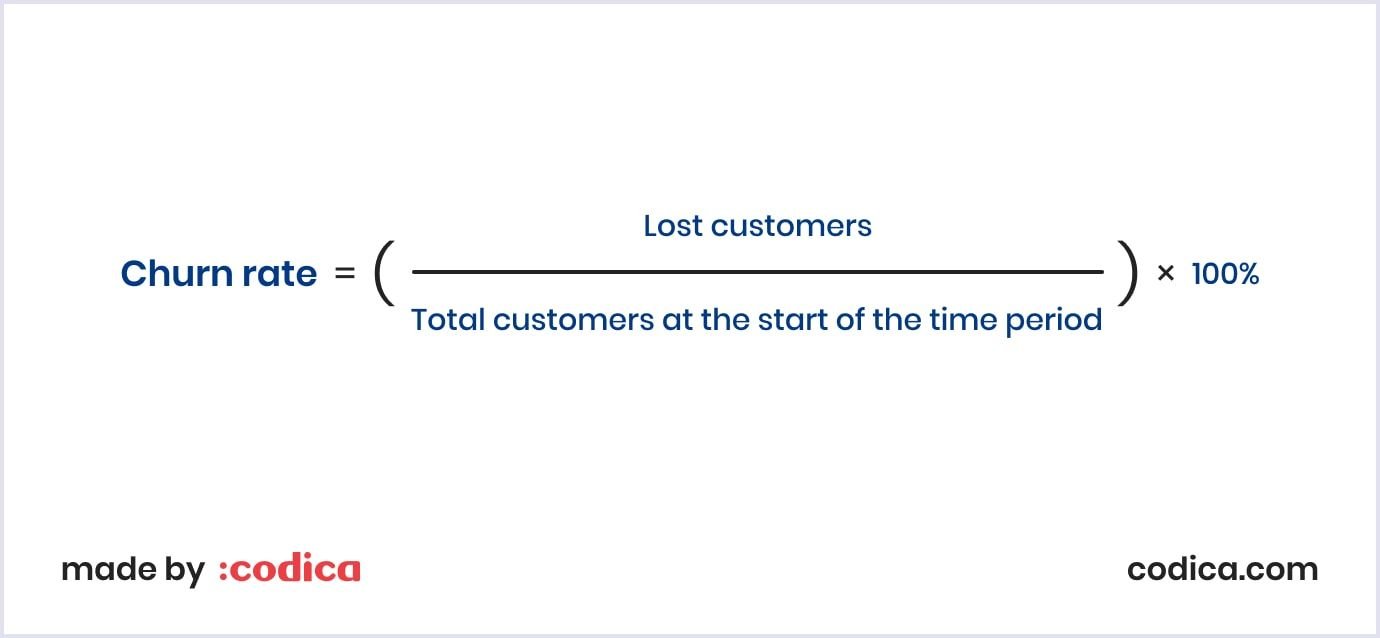

Churn rate

This metric for a marketplace, also known as attrition rate, shows the share of customers who leave your platform over a specified period of time. Calculate it with the formula below:

Importance of churn rate in identifying and addressing customer retention issues

Reducing the churn rate can help you stabilize and improve your financial performance. If you observe a high churn rate, check that you have a perfect product-market fit and provide enough value to your customers. Also, ensure that your customer support and vendor management work well.

By analyzing your churn rate, you can gain insights into your users’ journeys, their satisfaction with your marketplace, and their overall experience.

Liquidity

Marketplace liquidity shows that a transaction will likely happen in your marketplace. If an average seller or buyer on your platform is likely to make a transaction, your marketplace has high liquidity.

As marketplaces provide space for buyers and sellers, there are two types of liquidity: seller and buyer liquidity:

- Seller liquidity means that a listing will likely lead to a transaction within a specific period. The proportion of listings that sell within a specific time period is known as the sell-through rate. Liquidity increases with higher rates.

- Buyer liquidity means that a visit will likely lead to a transaction. The purchase rate is the proportion of distinct visitors to your marketplace that result in a sale. Buyer liquidity can be calculated by dividing the total number of transactions during a given period of time by the total number of unique visits. Simon Rothman of a leading venture capital firm, Greylock Partners, believes a good target range is 30% to 60% for this ecommerce marketplace metric.

Significance of liquidity in ensuring a smooth and efficient marketplace

High liquidity means many buyers and sellers are active on the platform. With more buyers and sellers, the marketplace can achieve better price discovery. Thus, liquidity expands network effects and increases the marketplace value as more users join.

Additional metrics for specific marketplace types

For B2C marketplaces

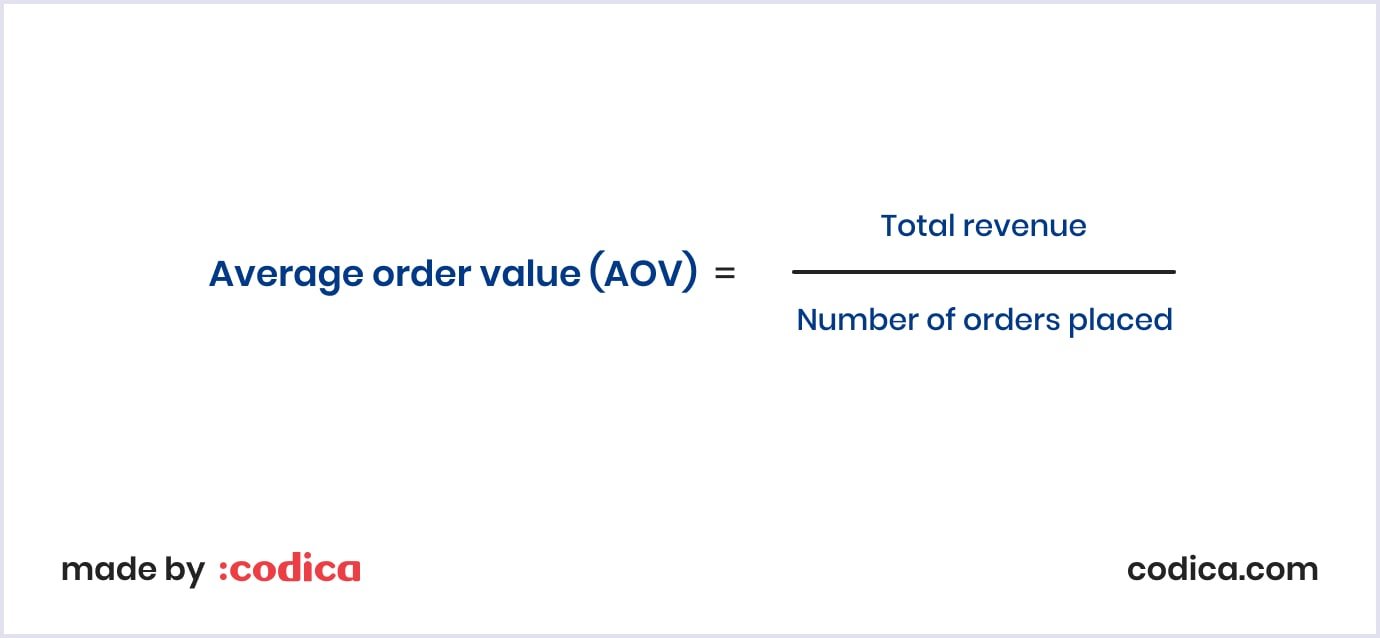

Average order value (AOV)

This metric shows the average amount customers spend placing orders on your marketplace. To calculate it, divide your total revenue by the number of orders. For example, if your total revenue is $3000 and you received 100 orders, your average order value is $30.

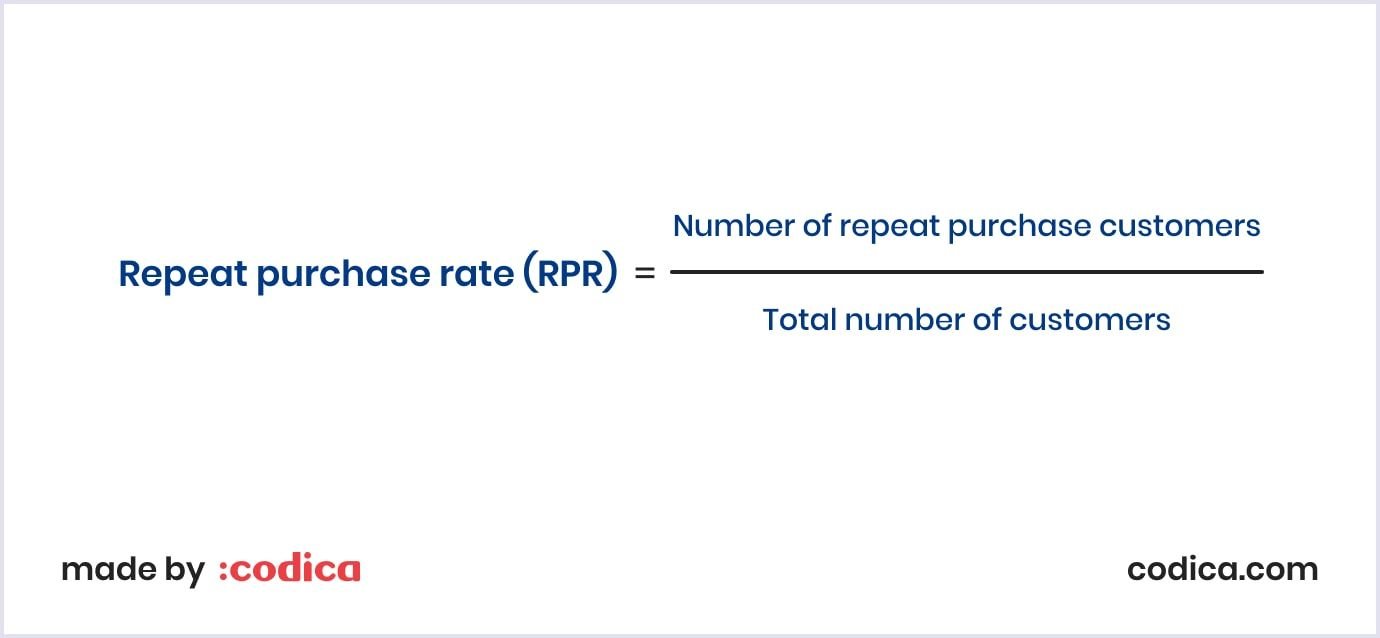

Repeat purchase rate (RPR)

This rate outlines the number of customers who return to your marketplace and the number of unique customers over a given period of time. It shows how many buyers bought from your marketplace again within a specific timeframe. The metric highlights customers’ loyalty and satisfaction with your platform. It is calculated as follows:

Customer satisfaction score (CSAT)

This measure shows that your customers have enjoyable experiences with your marketplace. You can obtain the score with surveys where you get answers from customers. Divide the total number of "very satisfied" and "satisfied" responses by the total number of responses to calculate CSAT. To obtain the percentage, multiply the outcome by 100.

This formula can determine the equal satisfaction rates of customers and vendors. As both sides are valuable to your marketplace, it is vital that they have pleasant experiences with your platform.

For B2B marketplaces

Number of enterprise customers

Customers from large companies, not small businesses, are called enterprise customers. Typically, large companies have 1000+ employees. Enterprise customers make orders for higher prices. Thus, securing enterprise customers ensures a higher revenue stream for your B2B marketplace.

Moreover, enterprise customers bring you strong relationships and, thanks to network effects, can help you attract more buyers. Such partnerships make your marketplace more credible and contribute to stable business growth.

Contract value

In terms of B2B marketplace metrics, contract value refers to two aspects:

- Contract value between the marketplace and an enterprise customer;

- Contract value between a seller and a buyer concluded on the marketplace.

This metric is helpful for revenue forecasting and informed financial planning. In this regard, this measure correlates with customer lifetime value, so you can understand the revenue you can gain from a particular contract.

Contract value also helps plan which audiences and market segments you can target for better profitability.

Customer net promoter score (NPS)

This metric measures that customers are likely to recommend your marketplace to others. Typically, you can use a simple survey question: “On a scale of 0 to 10, how likely are you to recommend our platform to a friend or colleague?” Based on customers’ responses, you can categorize them into three groups:

- Promoters (9-10): loyal customers who refer your platform to others.

- Passives (7-8): satisfied but unenthusiastic customers who easily switch to competitive offerings.

- Detractors (0-6): unhappy customers who can give negative feedback about your platform to others.

Such surveys often include follow-up questions asking to explain their rating.

The results can help you adjust your marketplace’s business strategy. High NPS shows business sustainability, thanks to customers’ loyalty and satisfaction.

On the other hand, medium and low numbers help you adjust your business. For example, you can pay attention to follow-ups and research how your competitors act in similar areas. Thus, you can set strategies for growth and improvement.

Wrapping up

Now, you know how to measure your success with the key marketplace metrics. The above metrics help you analyze your marketplace’s performance, adjust your strategies, and celebrate wins. Thus, the metrics help you ensure your platform’s stability and growth.

If you have a marketplace project in mind, contact us. We are eager to answer your questions and provide a free quote for online marketplace development.